Accurate comparison requires

Accurate comparison requires

Structured, well-formulated and matching data. If you’re missing data on one side, you can’t make an accurate comparison.

Unlock new revenue streams by nurturing inactive and unconverted leads, thanks to the only tech platform that allows advisers to compete with aggregators.

Integrates easily with all CRM systems

Enables advisers to compete with aggregators for the very first time

Exclusive access to never seen before mortgage products.

Ensure your clients have the best mortgage deal 24/7/365

Through our carefully considered customer contact strategy, Dashly is able to retain your existing clients, and attract new inactive leads.

Unlock new revenue streams by attracting inactive leads to your business, which may have been impossible to service before.

Turn your normal advice processes into automated, monthly and meaningful contact.

Once you partner, you'll have unlimited access to a huge amount of business boosting tools.

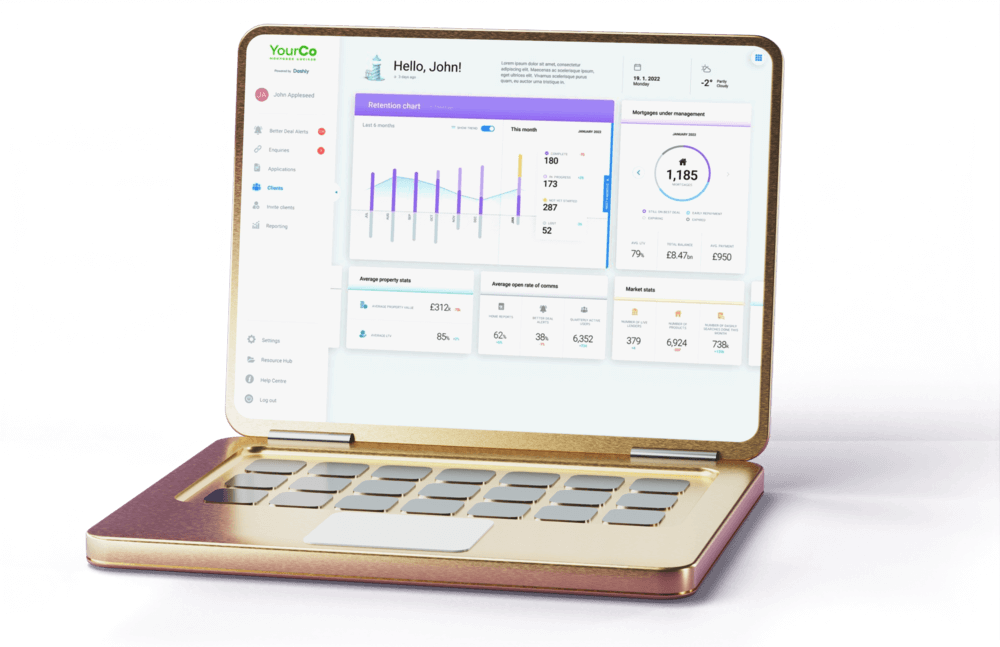

By tracking and comparing every one of your clients' financial circumstances against the entire market every day, Dashly can spot switching opportunities like no human ever could, that’ll save your clients money, give them peace of mind, and earn you more.

Book a demoDashly keeps your clients engaged thanks to a full suite of marketing materials, personalised to you. Keeping your brand front of mind all the way through to the next transaction.

We are fanatic about your satisfaction. Our team are available to make sure your experience with Dashly is as smooth as possible.

Book a demoEverything you need to know about your clients in one neat place. Whenever your client can get a better deal, we’ll let you know before any lender communication is even possible. Whether that’s mid-term, or 6 months before their deal ends, with Dashly you get there first.

Book a demo

Transform inaccurate and impartial records into 100% correct, structured data sets.

Structured, well-formulated and matching data. If you’re missing data on one side, you can’t make an accurate comparison.

MortgageDoc.AI is the only tool that can accurately restructure and rebuild your partial or incomplete mortgage records. Don’t get left behind.

MortgageDoc.AI works closely with Dashly to help identify any better deals your clients may be able to receive from their data, giving you even more touchpoints with them.

No coding or difficult systems are needed to use MortgageDoc.AI. Just drag and drop your PDF from your computer into the webpage, and we’ll do the rest.

Our FinComms Strategy 2.0 is now more sophisticated and personalised than ever. It allows you to offer your customers regular information about their mortgage that’s specific to their circumstances and every change in the market. Plus, it’s all automated.

Modular communication touchpoints are activated when they match a client’s circumstances. If they remain on the right rate, it’ll reassure them. If there’s a switching opportunity, it’ll alert them. Updated property valuations, product expiry dates, rate changes? All covered, and more.

Typical financial services open rates

Dashly home report open rates

Integrate your service across all touchpoints of your client’s lives

The answer is “Yes, it can.” If we’re working with them to deliver our 24/7 Mortgage Monitoring service, that is.

Once we are, you’ll be able to generate detailed reports directly from your CRM to send to us. Accurate and up-to-date data enables us to search for better deals for your customers.

Let us know who your CRM provider is. If we’re working with them, we’ll let you know.

Managing Director of Conran

“Dashly’s proposition suits us to a tee: it means our highly capable sales team can convert even more leads, and the business as a whole can develop more meaningful relationships with our customers by offering a tailored and personal service.”

Principal at Oakwood IMC

“Dashly shares our vision exactly, and combining its unprecedented access to the full spectrum of mortgage products with our team’s expertise will undoubtedly give us the edge on other firms, and chimes exactly with our pledge to give value for money with a highly tailored approach.”

Managing Director of UK Moneyman

“We’ve always prided ourselves on long-lasting relationships with our clients, which is exactly what drew us to using Dashly’s technology. It means our team is freed up to do what they do best - provide quality advice to mortgage holders - while the sophisticated platform scans the market to ensure they really are on the best deal at all times.”

CEO of Tenet Group

“Thanks to Dashly, our advisers can feel confident that they’re giving clients best in class bespoke mortgage advice. This, in turn, means better customer interactions, and client retention for years to come.”

Chief Executive of Paradigm Mortgage Services

“Dashly’s proposition, in many ways, has been tailor-made for Paradigm and its brokers: it allows firms to retain a strong brand identity while also taking advantage of highly-specialised technology to get the best deals for its clients, which in turn promotes loyalty and trust and, ultimately, increased earnings.”

Managing Director of Conran

“Dashly’s proposition suits us to a tee: it means our highly capable sales team can convert even more leads, and the business as a whole can develop more meaningful relationships with our customers by offering a tailored and personal service.”

Principal at Oakwood IMC

“Dashly shares our vision exactly, and combining its unprecedented access to the full spectrum of mortgage products with our team’s expertise will undoubtedly give us the edge on other firms, and chimes exactly with our pledge to give value for money with a highly tailored approach.”

Managing Director of UK Moneyman

“We’ve always prided ourselves on long-lasting relationships with our clients, which is exactly what drew us to using Dashly’s technology. It means our team is freed up to do what they do best - provide quality advice to mortgage holders - while the sophisticated platform scans the market to ensure they really are on the best deal at all times.”

CEO of Tenet Group

“Thanks to Dashly, our advisers can feel confident that they’re giving clients best in class bespoke mortgage advice. This, in turn, means better customer interactions, and client retention for years to come.”

Chief Executive of Paradigm Mortgage Services

“Dashly’s proposition, in many ways, has been tailor-made for Paradigm and its brokers: it allows firms to retain a strong brand identity while also taking advantage of highly-specialised technology to get the best deals for its clients, which in turn promotes loyalty and trust and, ultimately, increased earnings.”

A week-by-week breakdown of how easy it is to partner with Dashly.

Through a short, friendly chat, you’ll get a better understanding of just how Dashly can improve your business. We’ll work with you to get all the data necessary to perform a smooth set-up with minimum involvement on your side.

After your chat, we’ll start setting you up. We’ll provide a full Dashly set-up, plus all marketing collateral prepared under your logo and company details, ready for use. This will happen in a series of steps which looks a little something like this:

Once you’re set-up, it’s all systems go on using your new materials to nurture new clients. Get posting on social media and share your new landing page!

Now you’re nurturing new clients, it’s time to get your existing clients on board. We’ll need just a small amount of help in getting all of your customers’ data (mortgage offer PDFs and the like), and once we’ve got that we’ll cover the rest. It might take a bit of back and forth, but it’s a very smooth process.

So your existing clients are onboarded, and by now you’ve maybe even nurtured a few new ones. We can now start sending out their monthly reports to let them know they’re on the best deal and give them useful advice - personalised to them and their mortgage.

Read article

Property

Read article

Property

Read article

Property

Read article

Property

Read article

Property

Read article

Property

Read article

Property

Read article

Property

Read article

Property

Read article

Property

Delivering good outcomes for your clients is your Consumer Duty. Our 24/7 Mortgage Monitor makes this possible.

It tracks their mortgages daily to ensure they always receive the best value from their deals, while regularly reassuring them that you’re checking their mortgage(s) and that you’re there for them if they need you.

This consumer-first approach is not just our duty. It’s our company culture and we’ve been doing it since day 1.

Coming soon: Our lead generation tool not only finds new leads,

but nurtures them until they're ready.

Thank you for your interest in joining Dashly. Due to a high demand of interests, we are currently running on a waitlist for new applications. Please complete this form and we will notify you as soon as openings become available.