Say goodbye to…

Lenders looking at the competition, historical trends and the performance of old products when creating new ones.

Imagine creating a product tailored to a specific client, then delivering it to them directly in their inbox. Introducing Lending Labs.

Our data knows who the clients are, and what they need. Now lenders can offer them bespoke products using the world’s first data-driven mortgage personalisation platform.

We already have the data that targets individual clients for bespoke products.

Now lenders don’t have to spend a fortune on researching and marketing new products.

Advisers are presented with products that they previously would’ve had to find on a sourcing system.

Now advisers can offer these new products to brand new or existing clients directly in their inbox.

Thanks to all of this data, for the very first time, you'll be able to create products which empower your clients and provide value they're willing to pay for.

Show me how it works

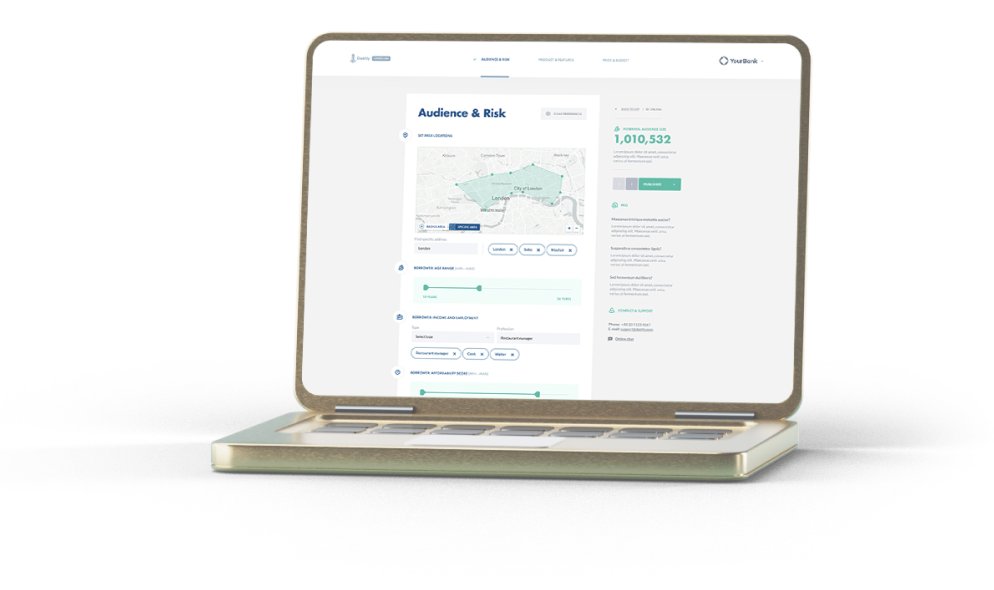

Conceptualise, create, analyse and manage products at any time with our dashboard, specifically designed for lenders.

Mortgage products have been created to combat competitor pricing. Now we can use advanced analysis to transform real-time borrower profiles into bespoke products.

Championing client needs.

Helping lenders and advisers to gain and retain their best clients.

See some of our solutions below.

It's not innovation for the sake of it. It's innovation because the mortgage market needs it.

fits the profile of cohorts of clients. Match your USPs with a live client database.

Launch products to improve consumers’ lifestyles by helping them to improve their EPC rating in their own home, and use our data to measure adoption prior to launch.

by launching products based on criteria that matches their client bank needs.

that look exactly like your best borrowers on a 1-to-1 level.

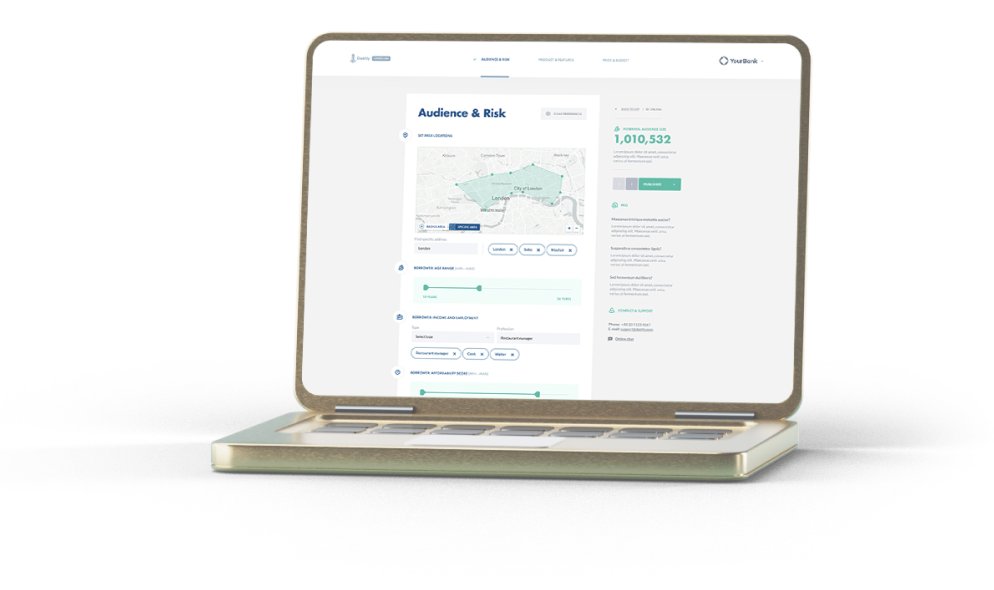

Predictive, personalised lending and real-time analysis that takes the friction out of matching the best interests of lenders and borrowers, with zero marketing spend. We unite all this data to produce the best results for everyone.

Lenders can create bespoke products that suit the needs of specific clients. First to market, no marketing spend.

Clients will receive mortgage deals that suit their specific circumstances, that no one else can offer them.

Advisers can offer unprecedented personalised service to their clients, increasing their client retention.

Lenders can create bespoke products that suit the needs of specific clients. First to market, no marketing spend.

Clients will receive mortgage deals that suit their specific circumstances, that no one else can offer them.

Advisers can offer unprecedented personalised service to their clients, increasing their client retention.