24/7

Mortgage Monitor

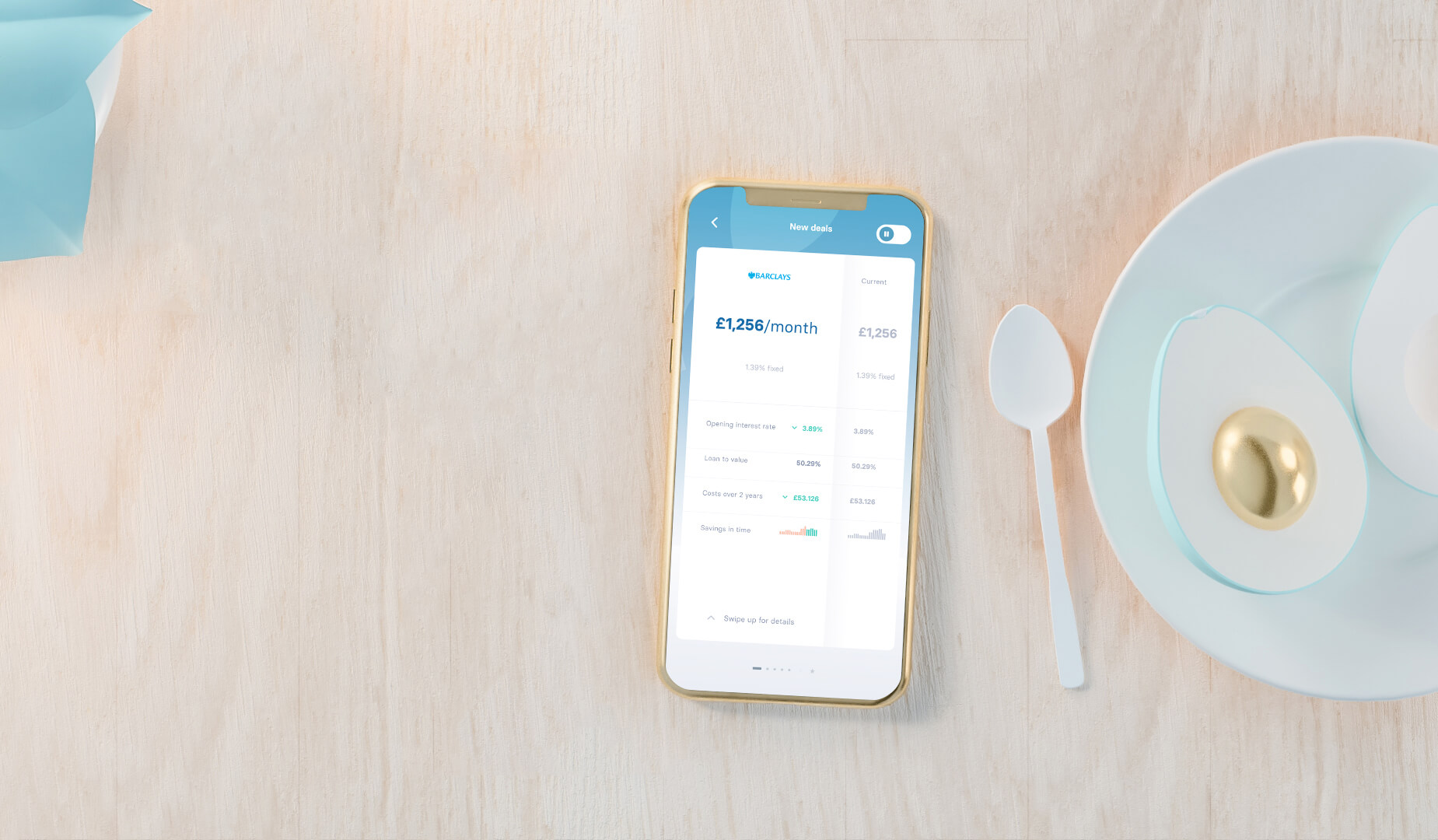

Take control of your mortgage, save yourself £1,000s* every year in interest and pay off your mortgage faster as a result by comparing your current deal 24/7, just in case.

Simple, easy sign-up

Answer a handful of simple questions about your mortgage or use our automatic sign-up process to be set up in a flash.

Stay on top of your finances

From changing property values to your next payment date, everything is right there on one simple screen. Monitoring your mortgage has never been easier.

Effortless switching

The app does all the maths, lays out your mortgage options with total clarity and then connects you with your trusted mortgage experts who can take care of everything for you. You can even track the progress of your application every step of the way.

App features

Property and

neighbourhood stats

Property and

neighbourhood stats

Research the latest property values and current market trends in your neighbourhood at a glance. Close

documents

in your pocket

documents

in your pocket

Back up and sync all your property related docs, bills, and mortgage paperwork to bank-level secure cloud storage and access them from any device. Share them with your mortgage adviser securely. Close

setup

setup

Set up and control your Blink smart fridge magnet - the world's first fridge magnet to save you £1,000s* on your mortgage. (For those that hate email or push notifications.) Close

tracker

tracker

Track your property value with a free monthly automated valuation. See current market trends in your neighbourhood at a glance. Close

and monthly

payments

and monthly

payments

View all your mortgage details, track your balances and equity all in real-time and in one place. Close

on the go

on the go

When Mortgage Monitor spots a better deal, comparing the new terms against your existing product couldn't be simpler, all the details are clearly displayed to ensure you're always able to make an informed choice. Close

for even better search accuracy Coming soon

passport Coming soon

overview Coming soon

Fridge magnet setup

Dashly Blink, the revolutionary magnet that saves you £1,000s* on your mortgage connects directly to your app via WiFi, and lights up only when it’s found you a better deal. If you’re not at home to see it, no worries! You’ll get an app notification.

What the media

says about

Mortgage Monitor

Mortgage warning as payments may rise by £500 - but downsizing could leave £205k windfall

See what our Sales Development Manager, Peter Harte said.

Nearly three quarters of brokers have not seen significant green product innovation in last year – poll results

Around 72 per cent of brokers said they have seen no change when it comes to lender innovation on housing energy efficiency, such as green mortgages, an exclusive Mortgage Solutions poll has revealed. See what our CEO, Ross Boyd says..

Industry reaction to Nationwide House Price Index

Latest UK inflation data better than expected, but what does it mean for mortgages and property? Experts react

Dashly’s message to brokers as EPC cost nears £14k