1

You sign up

It takes between 10-15 minutes

Mouseprice Mortgage Monitor's one time sign up takes 10-15 minutes. Then, it'll start challenging your mortgage against the entire market 24/7. Making sure you’re on the right deal, and making sure you never overpay on your mortgage interest again.

Manage your mortgage on the go.

Mouseprice Mortgage Monitor is available via desktop and app for both iOS and android. Making your mortgage even easier to manage, and making sure you never miss out on an opportunity to save.

Evaluate your mortgage with ease.

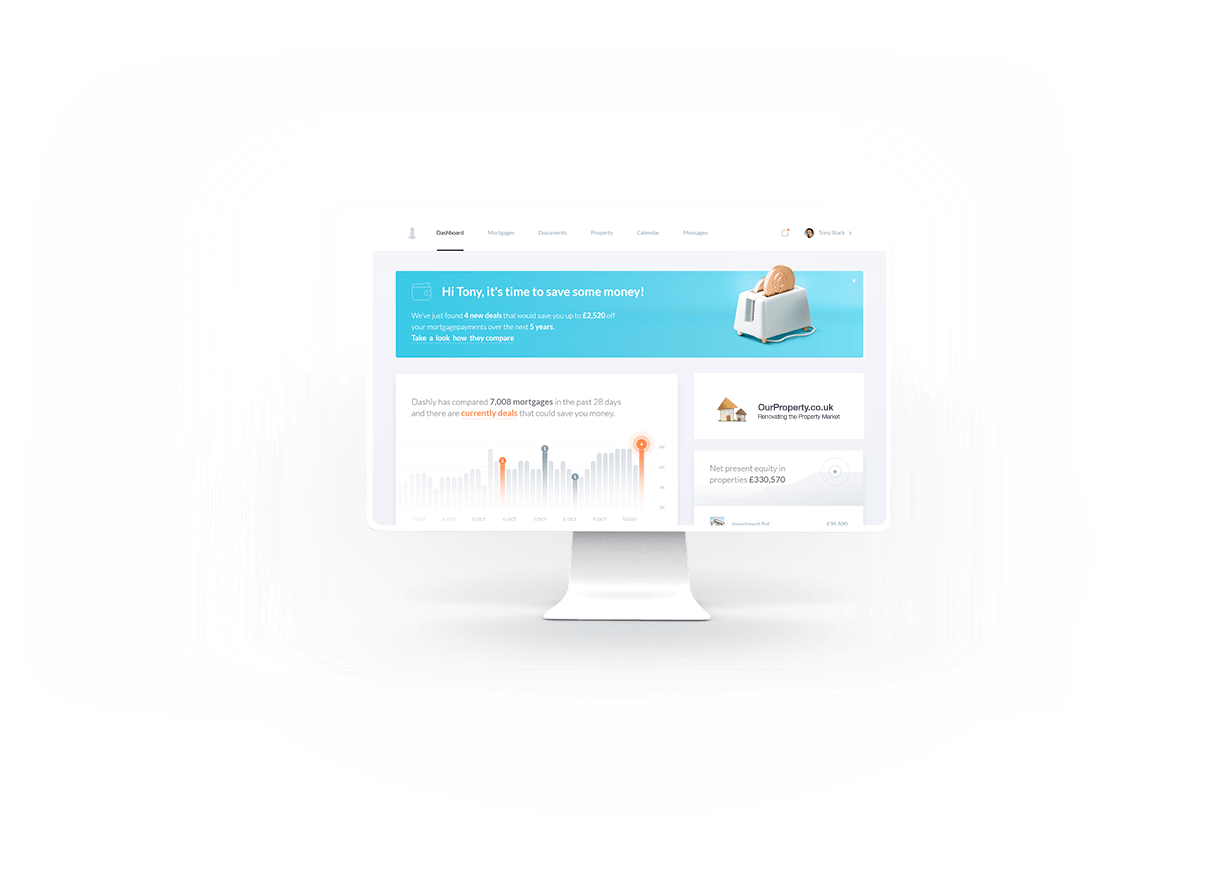

We do all the math so you can easily evaluate and choose the best deal for you. With our dashboard, it’s easy to see how different features stack up and exactly how much you can save month by month.

Get my own dashboard

Our dashboard gives you a clear view of only the important information about your mortgage. From changing property values to your next payment date, it’s all on one screen. Simple.

The world's first fridge magnet that saves you thousands*.

This revolutionary magnet connects directly to your app via WiFi, and lights up only when it’s found you a better deal. If you’re not at home to see it, no worries! You’ll still get a notification.

Fixed rate coming to an end? already lapsed?

Property Value

Mortgage

Term

LTV

$441,000

$441,000

27Y 3M

63%

Locked into a fixed rate already?

Property Value

Mortgage

Term

LTV

$290,000

$222,836

22Y 4M

77%

Mortgage deal already lapsed?

Property Value

Mortgage

Term

LTV

$460,000

$218,174

12Y 10M

48%

Buy to Let mortgage too small to be worth the effort?

Property Value

Mortgage

Term

LTV

$124,000

$67,143

18Y 4M

4%

The Mouseprice Mortgage Monitor has no hidden charges and will never hit you with advertisements or email campaigns to make money. Just independent, unbiased advice.

Our expert team gets paid out of mortgage provider fees, keeping our promise of keeping out of your pocket.

We’re founding members of Finance For Good, a charity run by social impact fintechs who put consumers first.

We’re authorised and regulated by the Financial Conduct Authority and our security rivals that of the world’s leading banks.